In today’s fast-paced, ever-evolving business environment, managing payroll is a critical, yet often complex, task for employers. With employees in various roles and compensation structures, accurate and timely payroll processing is key to maintaining smooth operations and fostering employee satisfaction. Paycor, a leading provider of HR and payroll software, offers businesses an innovative and efficient payroll solution to simplify these complexities. This article delves deep into Paycor Payroll, highlighting its features, benefits, and the reasons why it’s a standout solution for organizations of all sizes.

What is Paycor Payroll?

Paycor Payroll is a cloud-based payroll solution that helps businesses manage the payroll process from start to finish. The platform is part of the larger Paycor suite of HR solutions, which includes services for recruitment, employee benefits, time and attendance tracking, and talent management. Paycor payroll is designed to automate the time-consuming tasks associated with payroll processing, such as calculating wages, taxes, deductions, and generating tax reports, all while ensuring compliance with ever-changing labor laws.

Paycor Payroll serves a wide range of industries, offering flexibility and scalability for businesses of all sizes, from small startups to large enterprises. Its integration with other Paycor HR tools provides companies with an all-in-one solution for managing their workforce, making it a go-to option for many businesses.

Key Features of Paycor Payroll

1. Automated Payroll Processing

At the heart of Paycor Payroll is its automation capability. Once businesses input basic employee information, Paycor handles the rest. This includes calculating hourly wages, overtime, bonuses, deductions, and benefits. The system automatically computes federal, state, and local taxes, reducing the risk of errors that typically occur with manual processing.

With Paycor, payroll runs in a matter of minutes. Employees’ pay is calculated accurately and delivered on time, helping businesses save valuable time that would otherwise be spent on manual calculations. This level of automation ensures that businesses can focus on their core functions, while Paycor ensures that payroll is processed quickly and efficiently.

2. Tax Compliance and Management

One of the most challenging aspects of payroll management is staying compliant with tax laws. Paycor Payroll helps businesses navigate this complexity by staying up-to-date with changing tax regulations. The platform automatically calculates payroll taxes at the federal, state, and local levels, ensuring compliance with the latest tax rules.

Moreover, Paycor generates and files the required tax forms, such as W-2s, 1099s, and other essential documentation. It also helps ensure that the correct withholdings are applied to employees’ paychecks and facilitates the submission of payroll taxes to the appropriate authorities. This reduces the risk of costly penalties and compliance issues.

3. Employee Self-Service Portal

Paycor Payroll includes an intuitive employee self-service portal that gives employees easy access to their payroll information. Employees can view their pay stubs, access tax forms (like W-2s), update personal details, and even request time off—all without needing to involve HR. This self-service option significantly reduces administrative tasks for HR teams and enhances the overall employee experience by giving workers more control over their payroll information.

Additionally, employees can review their benefits, tax withholding preferences, and retirement plans through the portal, improving transparency and communication between employers and employees.

4. Flexible Payment Methods

Paycor offers a variety of payment options, including direct deposit, which is a highly secure and efficient way to pay employees. Employers can set up direct deposit for their workforce, ensuring that payments are processed on time without the need for paper checks. Direct deposit also reduces the risk of lost or delayed payments, which can happen with traditional checks.

Employees also have the option to split their direct deposit into multiple accounts, which adds flexibility and convenience. For those who prefer physical paychecks, Paycor also supports check printing, offering businesses the ability to meet the needs of all employees.

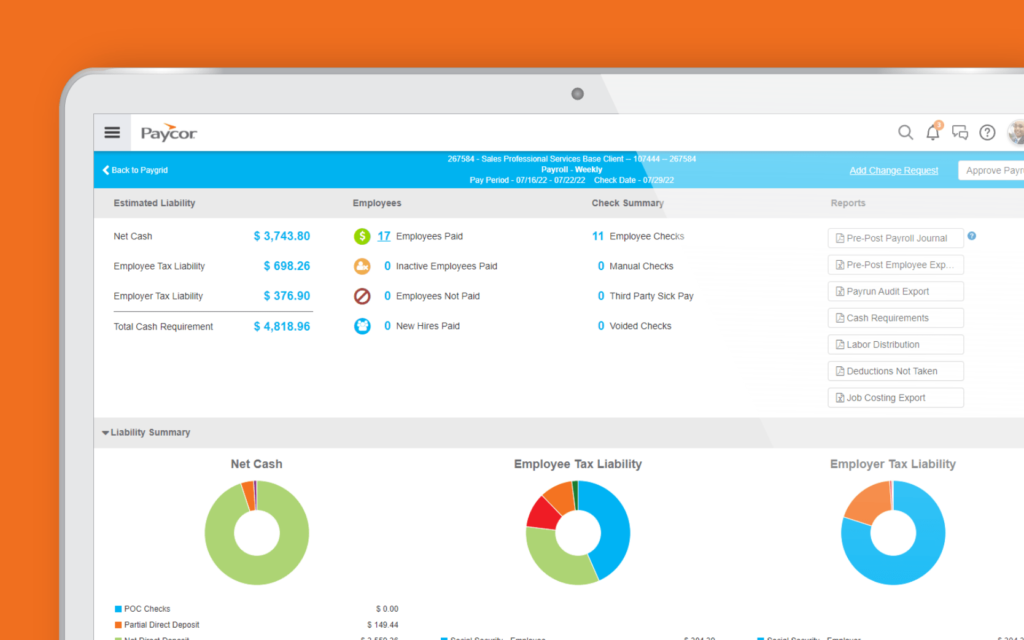

5. Real-Time Reporting and Analytics

Understanding payroll costs is crucial for any business, and Paycor provides real-time payroll reporting to help organizations make informed decisions. With Paycor’s reporting tools, business owners and HR managers can track labor costs, identify trends, and analyze payroll expenses by department, location, or individual employee.

The platform also includes tax reports and other essential documentation that can be used for auditing or financial planning. Customizable reporting ensures that businesses can generate the exact data they need to make strategic decisions and optimize workforce management.

6. Scalability for Growing Businesses

As businesses grow, their payroll needs become more complex. Paycor Payroll is highly scalable, which means it can adapt as businesses expand. Whether a business has 10 employees or 500, Paycor can handle payroll processing efficiently without sacrificing accuracy or performance.

Businesses can add new employees, update pay rates, or introduce new benefit structures without disrupting payroll operations. The scalability of Paycor Payroll makes it an ideal solution for companies at various stages of growth.

7. Integrated Time and Attendance Tracking

Time tracking is an essential part of payroll, especially for businesses with hourly employees. Paycor Payroll integrates with Paycor’s time and attendance tracking system, allowing businesses to accurately record employee hours and automate the transfer of time data directly into the payroll system.

This integration helps eliminate errors that can arise from manual time entry, such as incorrect overtime calculations or missed hours. By streamlining the time tracking and payroll process, businesses can ensure that employees are paid accurately and on time while reducing administrative overhead.

8. Mobile Accessibility

In today’s mobile-first world, Paycor Payroll offers a mobile app that provides easy access to payroll information anytime, anywhere. HR managers can process payroll, approve timesheets, and run reports directly from their mobile devices. Employees can access their pay stubs, request time off, and manage their benefits from their smartphones or tablets.

The mobile app enhances flexibility and convenience for both employers and employees, making it easier to manage payroll tasks on the go.

Benefits of Paycor Payroll

1. Time and Cost Efficiency

The automation of payroll processing and tax calculations results in significant time savings. With Paycor, businesses no longer have to spend hours manually calculating payroll or filling out tax forms. The platform’s self-service options further reduce the time spent on administrative tasks, allowing HR teams to focus on more strategic initiatives, such as employee development and engagement.

In terms of cost, Paycor’s all-in-one solution eliminates the need for multiple third-party systems, reducing subscription fees and integration costs. The overall efficiency of the platform helps businesses save both time and money.

2. Accuracy and Error Reduction

Manual payroll processing is prone to human error, which can lead to costly mistakes, such as incorrect tax withholding or miscalculated wages. Paycor eliminates these errors by automating the entire payroll process. With built-in tax compliance features and real-time calculations, Paycor ensures that employees are paid accurately, and businesses stay compliant with tax laws.

By reducing errors, Paycor helps businesses avoid costly penalties, fines, and employee dissatisfaction.

3. Improved Employee Experience

Employees appreciate being paid on time and having easy access to their payroll information. Paycor Payroll’s employee self-service portal allows workers to view their pay stubs, download tax documents, and make changes to their personal information. This transparency improves employee satisfaction and reduces the number of payroll-related inquiries to HR departments.

Moreover, with direct deposit and mobile access to payroll information, employees have a hassle-free experience that can improve morale and retention.

4. Enhanced Security

Payroll data is sensitive, and businesses must prioritize security to protect employees’ personal and financial information. Paycor takes security seriously with advanced encryption, secure data storage, and regular security audits. The platform ensures that payroll data is protected from unauthorized access, minimizing the risk of data breaches and ensuring compliance with data protection regulations.

5. Seamless Integration with Other HR Functions

Paycor Payroll integrates seamlessly with other Paycor HR tools, such as benefits administration, recruitment, and performance management. This integration eliminates the need for duplicating data entry and ensures that employee records are always up to date across all HR functions.

Businesses can track and manage employee data from recruitment to retirement using one unified platform, simplifying HR operations and reducing the likelihood of errors.

Conclusion

Paycor Payroll is a powerful, scalable, and user-friendly solution for businesses looking to streamline their payroll processing. With its robust features, such as automated payroll, tax compliance management, employee self-service portal, and mobile access, Paycor is a standout choice for businesses seeking efficiency, accuracy, and flexibility in managing their workforce.

Whether you’re a small business just starting out or a large enterprise with complex payroll needs, Paycor offers a solution that can grow with you. By automating payroll processes and improving compliance, Paycor helps businesses save time, reduce errors, and enhance the employee experience. For organizations looking to optimize their payroll management, Paycor provides a comprehensive and reliable solution that delivers both value and peace of mind.